We specialize in

Personal, commercial and life insurance

How we can help?

Client center

Our carriers

News from our blog

Though businesses often require different types of insurance depending on industry risks, every single business can benefit from general liability insurance. This type of coverage offers valuable financial protection to your business, as well as to your customers. In particular, this coverage can protect against the resulting expenses if your business is held responsible for injuring a third party or damaging their property. Essentially, it can save everyone involved in a covered incident from large out-of-pocket costs. What exactly is covered by general liability insurance? These incidents involve damages sustained by third parties that stem from your business and employees. Let’s look at a few examples of incidents that could be covered by general liability insurance. A customer enters your store, happy to be out of the rain for some shopping. She doesn’t see a puddle near the entrance and slips and falls on the tile floor, breaking a leg on her way down. She must get medical attention and miss a few weeks of work while she recovers. Since it’s the responsibility of your business to clearly mark hazards and promptly clean them, this customer can make a claim against you to recover her lost expenses and income. A delivery man enters your business with a parcel and is surprised to see clutter everywhere. He accidentally knocks a stack of junk with his toe, which causes a heavy object to fall on top of him. Again, his injuries can be attributed to your business since it’s your responsibility to maintain a safe, tidy workplace. An employee is painting the exterior of your store’s windows for the season and a metal cart full of supplies accidentally drifts away because the wheels weren’t properly locked. Before the employee can catch it, the cart slams into a customer’s car, leaving a huge dent and a broken tail light. This too would fall under the responsibility of your business. Even though your business takes safety precautions, accidents can happen at any time. And if a customer or other third party suffers an injury or property damage at the hands of your business, general liability insurance can provide the necessary financial support to get through the incident. At Skogman Insurance, we make insurance personal. You have a person on your side who understands your business and helps you choose coverage that truly fits your needs. Call us today at 319-366-6288 to learn more about business insurance and how we can protect what matters most to you.

The fall and winter seasons often bring storms that can cause tree limbs to fall onto power lines. Sometimes the extent of the damage is severe enough to cause power outages that last for days. Getting through these require advanced preparation on the homeowner's part. The following tips will help you ride out a power outage. Flashlights and Spare Batteries When the power goes out after the sun sets, the very first requirement is being able to see. There should be plenty of flashlights strategically located throughout the house in easily located places. Select these locations and don't change them because there won't be enough light to hunt around for them after losing power. Keep a plentiful supply of spare batteries in case the power outage lasts for several days. Battery Operated Phone Make sure to have a phone that is battery powered so that you can communicate with the outside world. This is important should an emergency occur that requires outside help. Cooler Keep an insulated cooler for storage of food that can spoil. A supply of ice in your freezer can be used to keep the contents in the cooler at a low temperature. A refrigerator can keep its contents cold for a number of hours, provided the door is never opened. However, this presents a problem when you get hungry. Leave a Light Switch On This will alert you when the power has returned. Keep Your Power Generator Outside Placing it in an enclosed area like the garage can result in dangerous levels of carbon monoxide buildup, which may find its way into your home. Keep a Supply of Water Depending on your situation, a power outage can mean no running water. This is certainly true if your water comes from a well. Each person will require one gallon of water per day. Food Supply Keep a food supply that will last for a few days. The food should not require cooking or refrigeration. Keep a manual can opener handy. Candles Power outages that last for days can use up flashlight batteries before the power returns. When you require ambient lighting for the rooms in your home, some types of candles can last for many hours, which allows you to conserve your batteries when you don't know how long you will be without power. The candles should rest on a sturdy, level surface and be used away from flammable items. Protect your family. Call Skogman Insurance at 319-366-6288 for more information on home insurance.

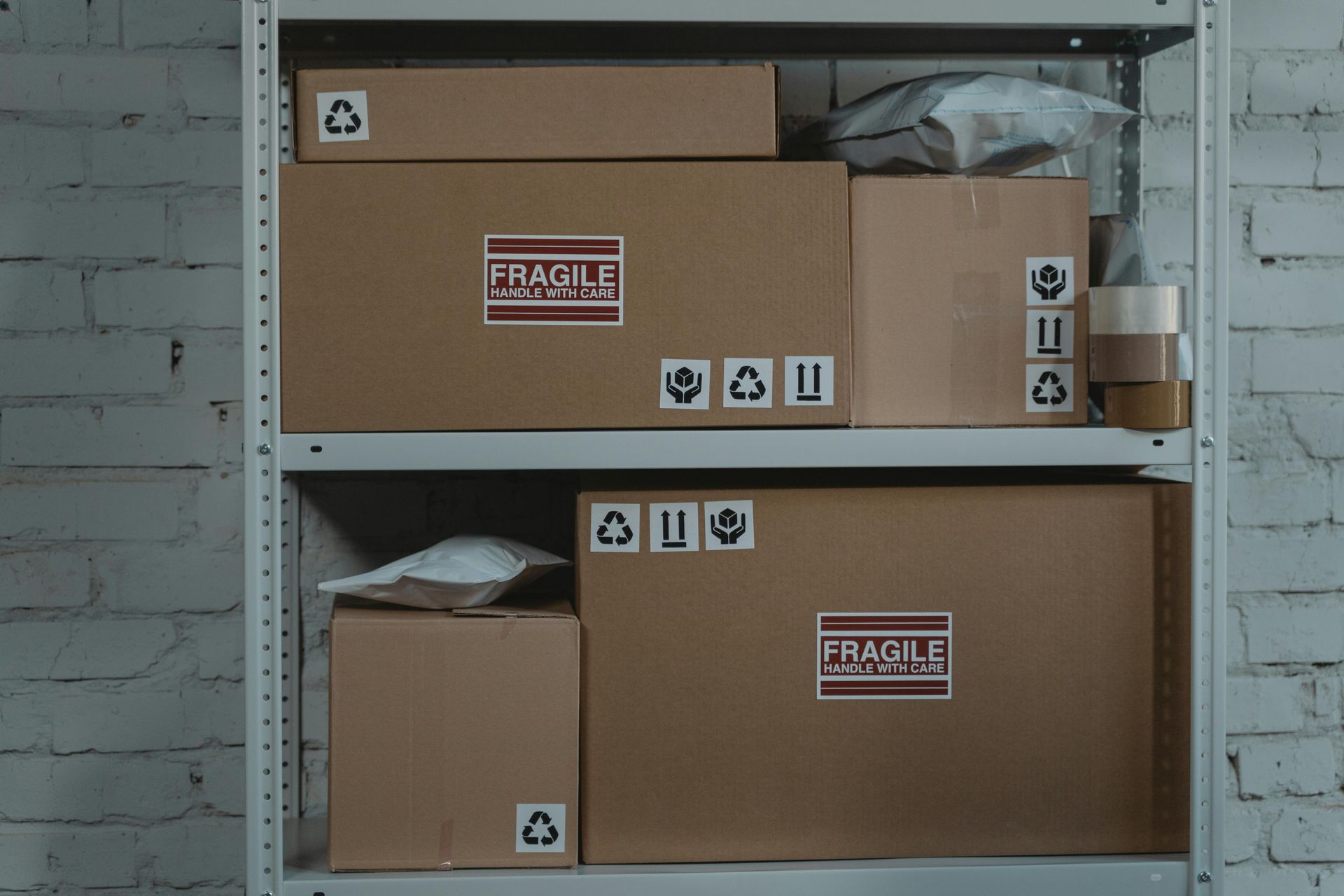

More Americans are working for themselves than ever before. According to a 2023 report from MBO Partners, more than 64 million people are classified as independent contractors, freelancers, or self-employed—and that number is expected to keep growing. From the flexibility of setting your own hours to the ability to work anywhere, self-employment comes with incredible freedom. But it also comes with risk. One of the most important safeguards you can put in place is business insurance. Who Needs Business Insurance? It isn’t just store owners or those with large inventories who need coverage. So do: Freelance writers and designers – at risk of copyright or defamation claims Photographers and videographers – protecting expensive equipment and potential liability issues IT consultants and web developers – vulnerable to errors, data breaches, or client disputes Repair professionals and contractors – needing protection in case of property damage or accidents on the job Even if you’re a one-person business, your livelihood could be at risk without the right protection. Business insurance not only covers liability but can also help replace stolen equipment, cover interruptions to your work, and protect your reputation. Types of Coverage to Consider Liability Insurance Protects you from lawsuits or claims filed against you by third parties. This includes physical injuries (like someone tripping at your office) and non-physical harm (such as an error in your work). Many self-employed professionals benefit from specialized coverage such as: Errors and Omissions Insurance (E&O): Covers mistakes or oversights in your professional services. Commercial Auto Coverage: Protects vehicles you use for business purposes. Property Insurance Covers damage or theft of the equipment you depend on every day—cameras, laptops, tools, servers, or even the space you work in. Additional riders may include: Business Interruption Insurance: Helps replace lost income if a disaster or fire prevents you from working. Inland Marine Coverage: Protects business property when it’s offsite or in transit. Peace of Mind for Every Business Owner The beauty of business insurance is its flexibility—it can be tailored to your industry, income level, and goals. With the right policy in place, you can spend less time worrying about “what if” and more time growing your business. At Skogman Insurance, we’ll help you find coverage that fits your unique needs. Because when you’re self-employed, you don’t just need a policy—you need a person who understands your business and cares about your success. Ready to protect your business? Call Skogman Insurance today at 319-366-6288 to learn more.

Businesses rely on a wide range of physical assets—including buildings, furniture, technology, inventory and raw materials, among others—to conduct their operations successfully. The loss, damage or destruction of this property could wreak havoc on any business. That’s why it’s important to have adequate commercial property insurance in place. Commercial property insurance is designed to cover this a business’s physical assets if these items are damaged or destroyed as the result of various covered events. Generally speaking, there are two different types of commercial property policies. This includes: All-risk policies : These policies can cover losses that result from a variety of events—such as fires, wind, hail, lightning, theft and vandalism. Yet, keep in mind that standard coverage typically excludes certain weather events, including floods and earthquakes. Peril-specific policies : These policies can cover damages that occur as the result of specific, policy-named perils. For instance, a business may require fire coverage if its property faces an increased risk of experiencing that peril. Commercial property insurance covers a variety of physical assets. However, you may need to purchase policy endorsements (also known as riders) for certain high-value items—including specialized equipment and custom fixtures. Call your insurance agent for a customized assessment of your business’s unique coverage needs. You can then purchase a commercial property insurance policy with confidence, knowing that your commercial assets will be fully protected. Ask us for an evaluation today. Call Skogman Insurance at 319-366-6288 for more information on business insurance.

Delivery Drivers and Liability: What Homeowners and Renters Need to Know When a delivery driver steps onto your property to drop off a package, it might seem like a simple transaction. But if an accident occurs—like a fall on an icy walkway—you could be facing more than just a delayed delivery. Many homeowners and renters don’t realize they could be held financially responsible if a driver gets hurt on their property. So, who pays for the injuries? And does your insurance offer protection? This post will help clarify your responsibilities and how insurance may come into play. Your Responsibility as a Property Owner By ordering a delivery, you’re inviting someone onto your property to complete a business-related task. In legal terms, this makes the delivery driver an “invitee.” That status means you, as the property owner, have a duty to maintain a reasonably safe environment for them. You’re expected to take care of hazards like icy sidewalks, tripping hazards, blocked pathways, or even unsecured pets. If you’re aware of a danger that isn’t obvious, you’re also expected to warn the driver. What Happens if a Delivery Driver Gets Hurt? In many cases, the delivery driver’s employer will have a workers’ compensation policy that covers on-the-job injuries. However, if the injury was caused by unsafe conditions on your property, the workers’ comp provider might seek reimbursement from you through a process called subrogation. This means they could demand you cover the costs of medical treatment they paid out. That’s where your homeowners insurance could step in. Most policies offer liability coverage that may help cover those costs—assuming the injury was due to your negligence. It’s important to understand the details of your policy and speak with your insurance agent if you’re unsure about what’s covered. Renters: Are You Covered? For renters, liability gets a little more complicated. If a delivery driver is bitten by your dog, your renters insurance might provide coverage for that injury. But if the injury is caused by something related to the condition of the property—like a broken step or uncleared ice—it may fall under your landlord’s responsibility. The deciding factor usually lies in your lease agreement. Some leases shift certain maintenance duties, like snow removal, to the tenant. That’s why it’s essential to review your lease to understand where your responsibilities begin and end. Protect Yourself with the Right Guidance Understanding liability as a homeowner or renter can be tricky—but you don’t have to figure it out alone. A trusted Skogman Insurance agent can help you review your current policy, explain your coverage, and make sure you’re protected from the unexpected. Reach out to us today, we're here to help!

The Fourth of July is right around the corner, bringing a full weekend of parades, fireworks, and patriotic fun. To help you plan, we’ve rounded up some of the best local events happening nearby. Whether you're looking for a family outing or a great spot to watch the fireworks, there are plenty of ways to celebrate Independence Day this year! Cedar Rapids, Hiawatha, Swisher, & Robins: Celebration of Freedom Fireworks - One of the largest firework displays in the state of Iowa takes place on Friday, July 4th, at 9pm. Prior to the firework show, festivities will be all day starting at 12pm – from live performances to bounce houses, people of all ages will enjoy the celebrations. Kernels Post Game Fireworks - Celebrate the Fourth of July at the Cedar Rapids Kernels stadium for an evening packed with fun and festivities! Tickets are just $10 per person, with live music from Not Quite Brothers kicking off at 7 PM. The night ends with the firework show at 9:30 PM. It’s a celebration you won’t want to miss. Marion: Fireworks & Fireflies - Join the fun on Thursday, July 3rd at the scenic Klopfenstein Amphitheater in Lowe Park for an evening full of celebration! The parking lot opens at 4 PM, with live music from The Ice Breakers starting at 7 PM. The night wraps up with a spectacular fireworks display beginning at dusk. North Liberty: Fireworks in the Park - Join for an amazing evening of fireworks on Thursday, July 3rd, at 9:30pm at Penn Meadows Park! Grab your friends, family, and lawn chairs, and get ready to celebrate. North Liberty’s Fourth of July Celebration - Celebrate the fourth with a whole day of activities! Enjoy a festive parade at 2pm, a firework show at dusk, and plenty of exciting activities in between! With something for everyone, this will be a family-fun event that you will not want to miss. Iowa City: 4thFest - Coralville’s annual Fourth of July celebration will take place Thursday, July 3rd and Friday, July 4th at S.T. Morrison Park! This two-day event is packed with fun for all ages! From a 5K run and free concert to a petting zoo and an incredible fireworks show, you won’t want to miss a moment of the festivities. Iowa City Fireworks - This show will take place on Saturday, July 5th, at the Old Capitol Museum, at 9:30pm. Wrap up the holiday weekend at this amazing show in the heart of downtown. No matter where you choose to celebrate, we hope your Fourth of July is filled with community, fun, and –most importantly–safety. Happy Fourth of July from all of us to you!

You’ve probably heard about the lawsuits involving fast food customers getting burned by hot coffee or pub patrons getting injured in a bar fight. The reason these cases came to fruition is because businesses are legally liable for providing a safe place for patrons of all types; a place that also serves safe food and/or creates safe products. The idea of a liability issue may seem unlikely, but the truth is that these types of lawsuits are becoming more and more common in today’s litigious society. So what can you do to protect your business from the costly expenses of a lawsuit? Purchasing commercial general liability insurance can protect your business from a variety of events that may result in third party injury or property damage. Specifically, this form of coverage can help protect against the resulting expenses if your business is held liability for injuring a third party or damaging their property. To clarify, general liability insurance does not prevent a customer from filing a lawsuit against your business. However, it can cover legal fees, medical expenses, awarded settlements and—in some cases—PR services to repair your company image following such lawsuits. Without general liability coverage, these costs could grow high enough to cause significant financial concerns, even if a lawsuit winds up being frivolous. Are you ready to learn more about protecting both the safety of your customers (as well as other third parties) and the interests of your business? Consult your independent insurance agent to learn more about general liability insurance today. We’ve got your back. Call Skogman Insurance at 319-366-6288 for more information on general liability insurance.

The school year is winding down and for many that means it is time for a summer road trip. Of course, you want to make sure your trip to and from your vacation destination is safe. Here are some tips to help you have an accident-free summer trip! Planning Plan as much detail as possible in advance so there’s no need to figure out where you are going while you are driving. Before you leave, map out your trip. Find out if you should expect any extensive construction on your drive. Look into options for places that you can stop and take a break. Consider restaurant options for meals. In addition, if your drive is very long, consider breaking it up into more than one day with a hotel stop in between. If you don't want to stop overnight, make sure you switch drivers so one person doesn't become too fatigued. Check the Vehicle Condition Check to make sure you have enough windshield washer fluid and that your last oil change was done recently. Measure the tire air pressure to verify it is adequate. Consider having an inspection done if you are concerned about the way the car is running before you leave. You really don't want to have a breakdown on a highway. If you wind up in that situation, make sure you pull off as far as possible. Getting completely off the highway is ideal since the shoulder is not very safe for car repairs. Always Buckle Up Make sure everyone is properly buckled in the car every time you are driving, including short excursions such as a trip from the hotel to the beach. Children need to be properly restrained in the correct car seat. If necessary, pull off the road to handle a dicey situation! Consider the drive as part of the adventure and don't try to rush it. Take it easy, enjoy the drive and have a wonderful, safe vacation! Don’t forget about your coverage. Contact Skogman Insurance for any questions about your auto insurance before you hit the road.

While it is great to have a business owner’s policy (BOP) to protect your company against loss, it is just as vital to take steps on your own to prevent a claim. These four methods are a great way to ensure tools and supplies don’t mysteriously disappear without your knowledge. Here are a few tips on how contractors can reduce theft claims. Increase the Amount of Lighting at Job Sites and Consider Cameras Law enforcement often touts that light is the biggest way to prevent would-be theft. In the case of construction sites, this is incredibly true. Ensure your work yard has proper security lighting during the overnight hours. It can help to keep away potential thieves. You can also consider adding smartphone accessible cameras to keep an eye on things when you’re away. Check Inventory Regularly and Be Present as a Manager It doesn’t matter if you’re a construction company owner, superintendent, or job site manager. Checking inventory regularly and being consistently present is incredibly important. Why? Many BOP claims include thefts by employees and subcontractors. If you monitor those who regularly work with your business and your involvement is commonly known, you can help reduce the chance of an incident happening. Keep Clear Records Another way to prevent theft claims against your business is by keeping records. Know exactly when supplies arrive at a job location and log the names of all employees involved at the time. This ensures that if anything ever comes up missing, you know who was around when it happened. Remember Protection Even on Small Jobs Not all contractors have large construction sites to monitor. Even if your job is on the smaller side, it is still important to take the necessary precautions. If your client is still living in the renovated home, ask them to keep an eye on things for you, as well. Final Thoughts – Having the Right Business Insurance Having a business owner's policy is a great way to protect yourself against risks, and enjoy plenty of protection for your business property, including tools and supplies. But that isn’t the only place you need a high level of coverage. Things like workers' compensation insurance, commercial auto insurance, and excess liability coverage are all still an important part of your overall protection portfolio. The biggest part of making sure you have enough business insurance coverage starts with talking to an agent. Contact our team today to schedule an appointment.